Is Gift Voucher Taxable In Malaysia

A non-cash gift voucher which can be spent in a retail store should be acceptable. The issuer will not pay any GST in the GSTR-3B filed for month of April 2020 because there is no way of determining the applicable tax rate till the time voucher is redeemed.

14 Employee Benefits That Are Tax Exempt

If a gift exceeds the exemption.

Is gift voucher taxable in malaysia. Cash vouchers are taxed in full in the same way as regular pay on the full face value of the voucher regardless of the cost to the employer. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. INLAND REVENUE BOARD OF MALAYSIA PERQUISITES FROM EMPLOYMENT Public Ruling No.

Cash and non-cash gifts relating to festive and special occasions which do not exceed the exemption threshold of 200 are considered to be not substantial in value and are not taxable due to an administrative concession granted. Monthly Tax Deduction MTD 34 12. There are no inheritance estate or gift taxes in Malaysia.

The cost of the gift including VAT does not exceed 50 per employee. The gift is not cash or a cash voucher a voucher which can be exchanged for cash. However where the conditions in Division 100 apply the supply of the voucher is generally not treated as a taxable supply.

The objective of this Public Ruling PR is to explain the tax treatment on perquisites from an employment received in respect of having or exercising the employment in Malaysia. The default position is that a supply of a voucher will be a taxable supply where the requirements of section 9-5 are met. The gift is not provided under a salary sacrifice or other arrangement.

This includes vouchers that are. Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a P ublic R uling in relation to the application of any provisions of ITA. 28 February 2013 - Gift of a new personal computer - Non-application 32 33 9.

No other than real property gains tax on gains arising from disposal of real property or shares in a real property company. Although the tax would be paid throughout the production and distribution chain only the value added at each stage is taxed thus avoiding double taxation. 22013 Date of Issue.

These are taxable benefits. Based on the above a gift card can be a voucher. In Malaysia a person who is registered under the Goods and Services Tax Act.

63 Inheritance and gift tax 64 Net wealth tax 65 Real property tax 66 Social security contributions 67 Other taxes 68 Compliance 70 Labor environment 71 Employee rights and remuneration 72 Wages and benefits 73 Termination of employment 74 Labor-management relations 75 Employment of foreigners 80 Deloitte International Tax Source 9. Are there any gift wealth estate andor inheritance taxes in Malaysia. General GiftPrepaid vouchers Voucher issued in April 2020 for Rs1000- redeemable against goods or services taxable at various rates including exempt goods or services.

What to report and pay. The market value of a voucher is the amount of money or the value of goods you receive when you use it. Deduction Claim By Employers 35.

Employees Responsibilities 34 11. According to the Income Tax Rule 37iv under the Section 172viii of the Income Tax Act 1961 the valuation of perquisite by way of any gift or voucher or token in lieu of which such gift may. A voucher is a token that can be exchanged for goods or services.

Employers Responsibilities 33 10. Gift of money to the government state government or local authorities. As an employer you might provide your employees with vouchers for certain goods including meal vouchers.

Payment of tax is made in stages by the intermediaries in the production and distribution process. Relevant Provisions of the Law The provisions of the Income Tax Act 1967 ITA related to this PR are sections 2 7. Only exchangeable for goods or services.

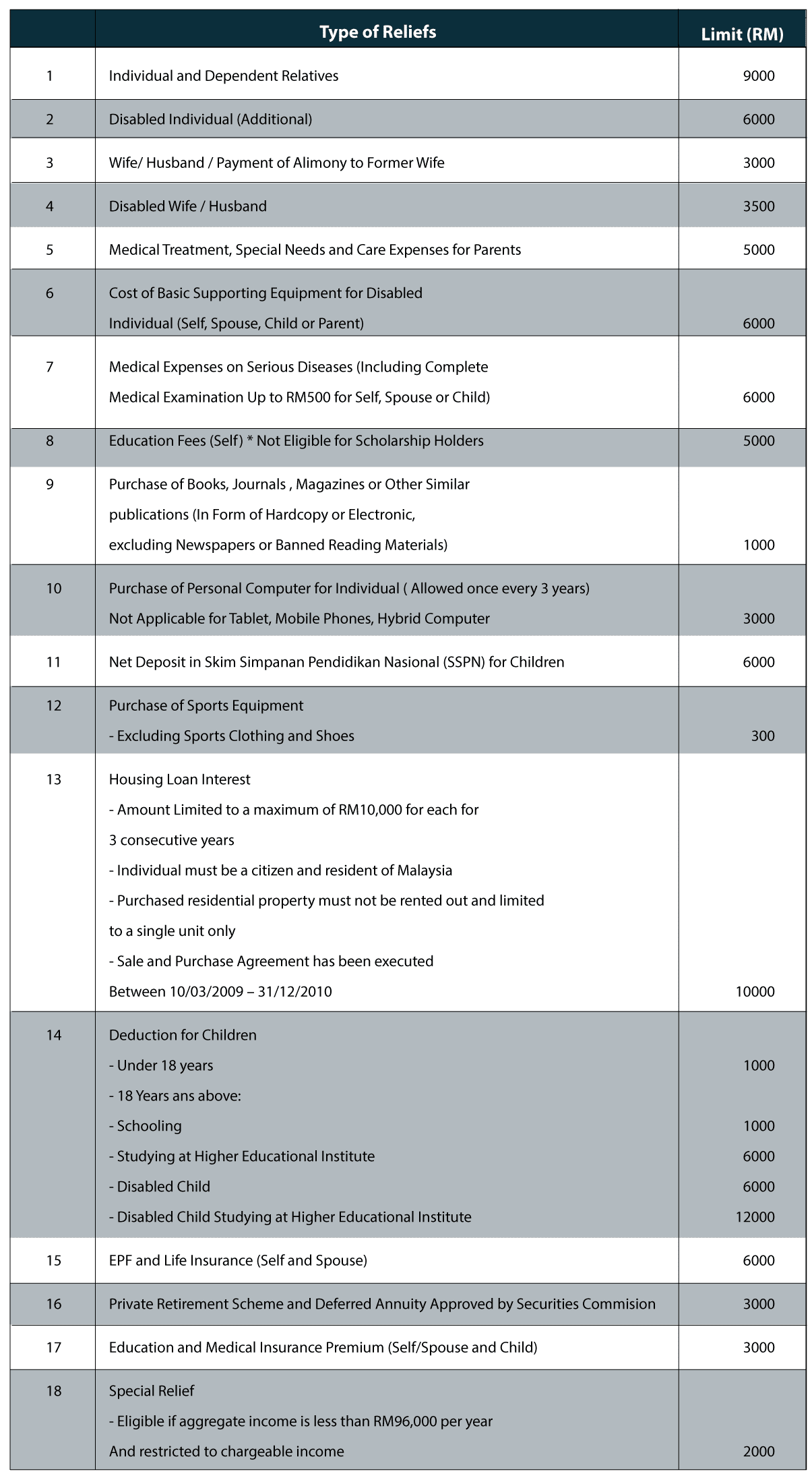

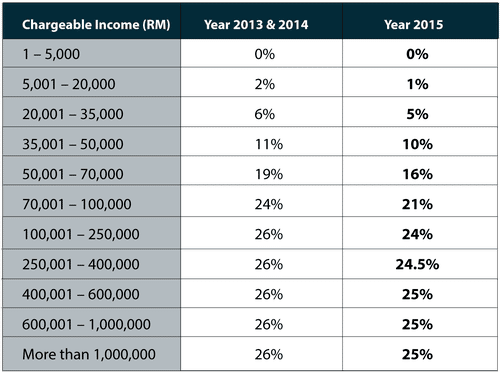

Everything You Should Claim As Income Tax Relief Malaysia 2020 YA 2019 Malaysia Personal Income Tax Guide 2020 YA 2019 Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia. In this case if the donor is a taxable person he still needs to account for the output tax on the supply of goods or services as gifts. The employment income of an individual who is a knowledge worker and resides in a specific region Iskandar Malaysia exercising employment with a person who carries on any qualifying activity namely green technology biotechnology educational services healthcare services creative industries financial advisory and consulting services logistic services and tourism will be taxed at the.

Goods or services acquired with costs more than RM500 but the input tax incurred was not claimed and the goods or services are given as gifts. However these gift vouchers too like any financial transactions and other sources of income undergo tax deductions under the Income Tax rules. There are different rules for childcare vouchers.

Malaysia Income Tax Guide 2016

Https Www2 Deloitte Com Content Dam Deloitte My Documents Tax My Tax Emp2015 Ges 2016 21jan2016 Noexp Pdf

Inland Revenue Board Of Malaysia Pdf Free Download

Dividend Voucher Template Download

Malaysia Income Tax Guide 2016

14 Employee Benefits That Are Tax Exempt

E Voucher Gst Malaysia O Presente Ao Cair Da Noite

Https Www2 Deloitte Com Content Dam Deloitte My Documents Tax My Tax Emp2015 Ges 2016 21jan2016 Noexp Pdf

Posting Komentar untuk "Is Gift Voucher Taxable In Malaysia"